- Ethereum price over $35M moved to exchanges by establishments.

- Market indicators are nonetheless bullish on ETH.

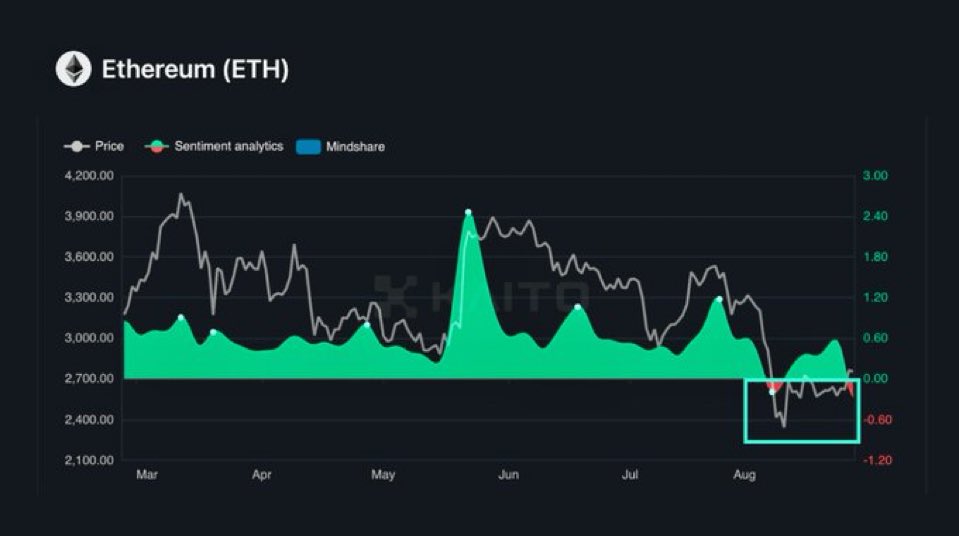

Ethereum [ETH], the second hottest cryptocurrency, has skilled important fluctuations lately, partly as a result of a big motion of ETH by establishments to exchanges.

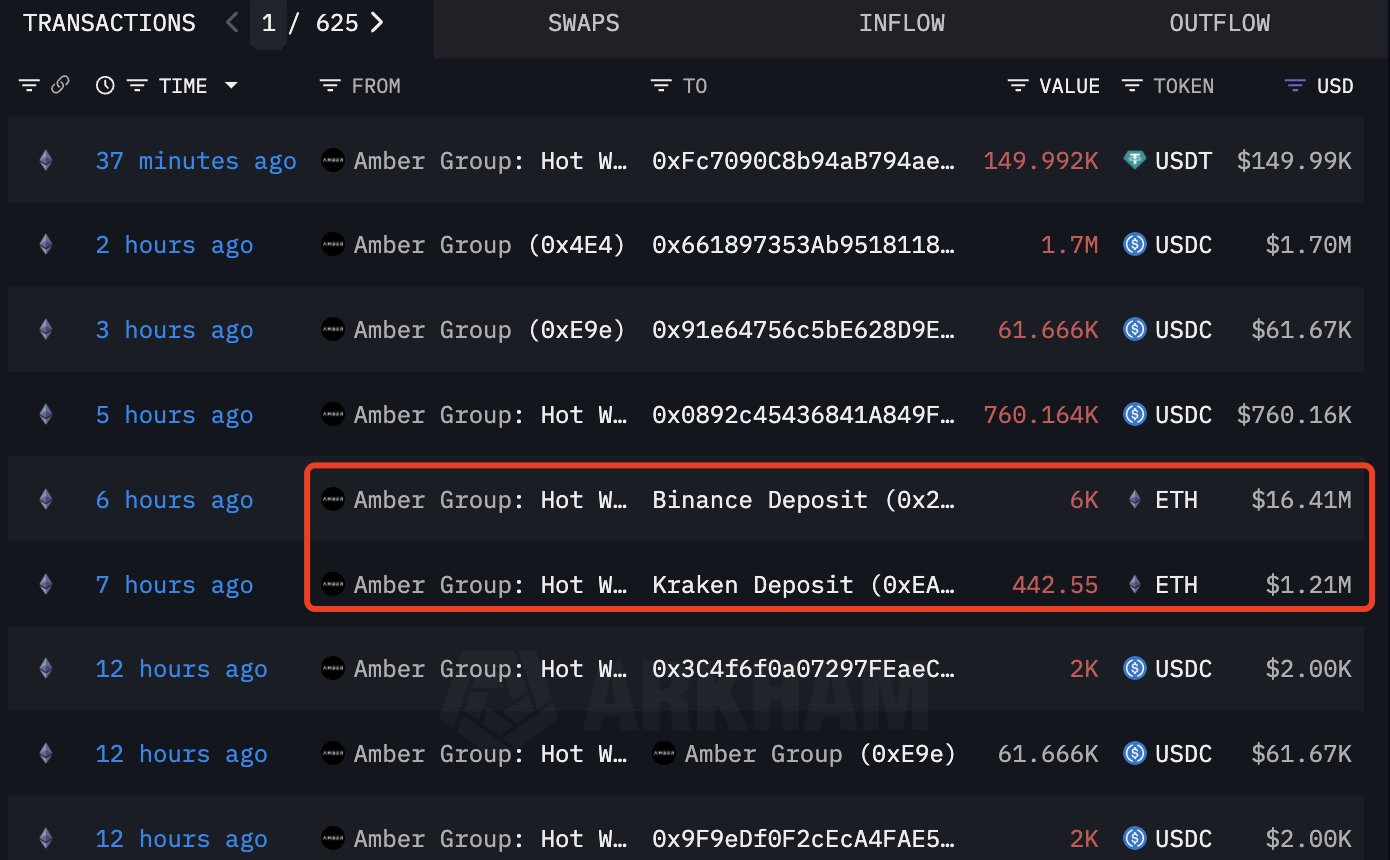

Over the previous 24 hours, main gamers like Amber Group and Cumberland have deposited giant quantities of ETH—6,443 and 6,439 ETH respectively—to exchanges that’s Binance and Kraken.

This inflow has raised issues concerning the affect on Ethereum’s value, which has seen each upward and downward motion in response.

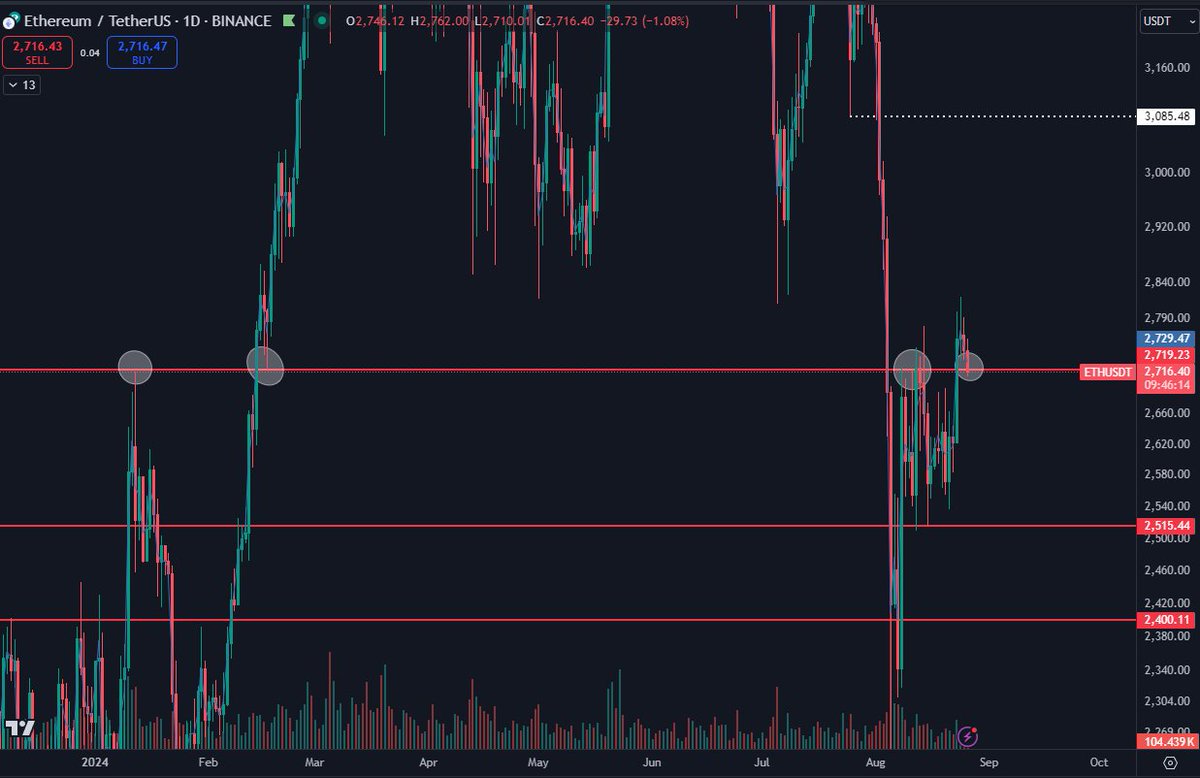

Value motion of ETH/USDT

Presently, Ethereum’s key assist degree on the day by day chart is round $2,720. This degree has confirmed to be important this yr, and its capability to carry may pave the way in which for ETH to focus on the $3,000 area.

Nonetheless, if this assist fails, ETH may drop to the following important degree at $2,500.

Regardless of current declines, the $3,085 degree is inside attain, significantly if ETH can get well from its current losses and shut the hole attributable to 5 consecutive down days.

The weekly timeframe has additionally retested the breaker space, suggesting a robust potential for an ETH backside. Endurance over the following 10 days shall be essential to substantiate the anticipated upward value motion.

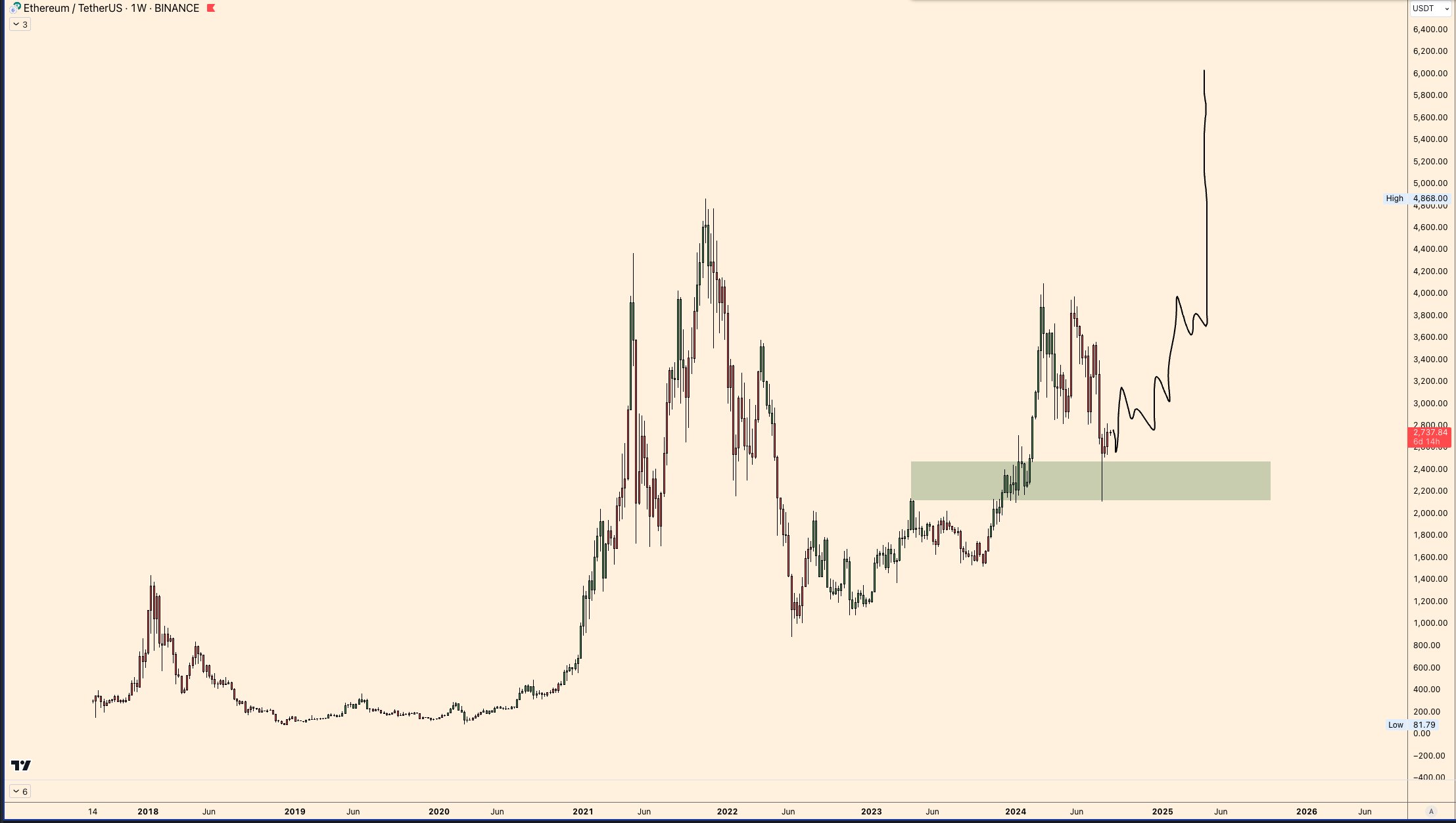

Incoming altcoins dominance

Ethereum additionally stands to profit from a possible resurgence in altcoin dominance. Traditionally, altcoins have seen important rallies following durations of assist at key ranges, and ETH, as a number one altcoin, is poised to capitalize on this pattern.

Supply: TradingView

Market cycles recommend that altcoins, together with Ethereum, may expertise a significant bull run within the subsequent 6-9 months, offering additional upward momentum.

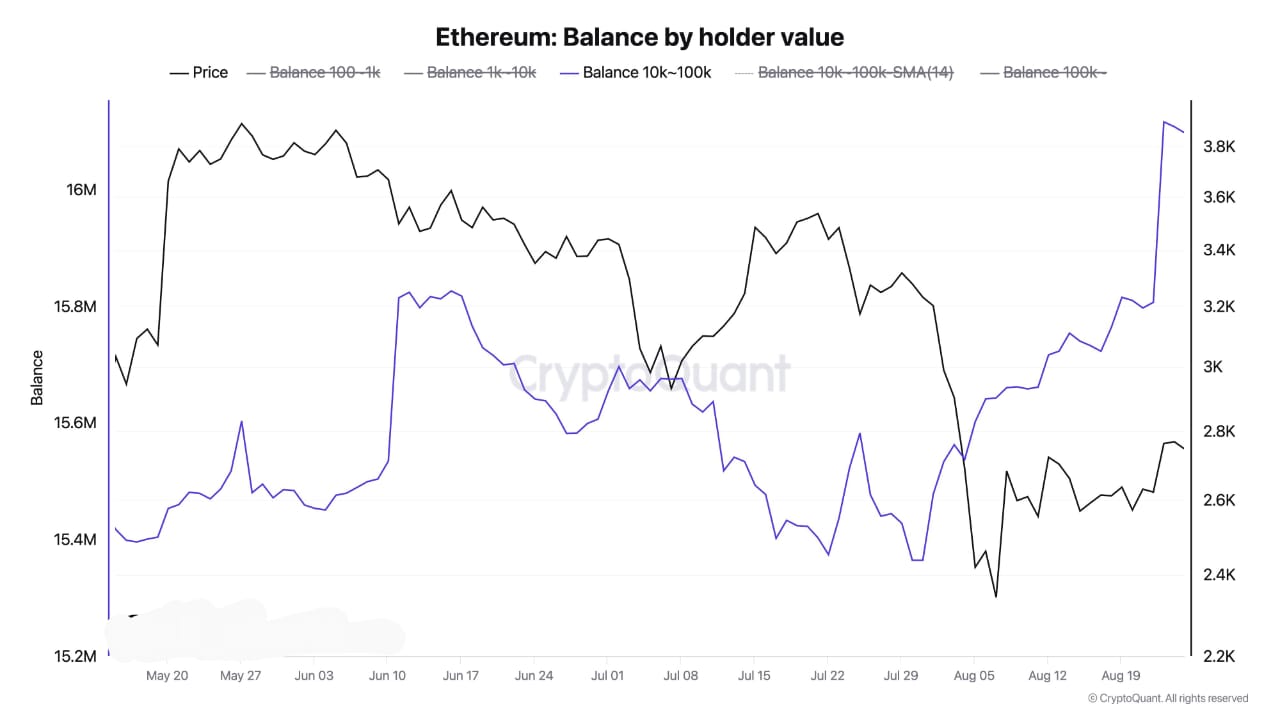

Growing whale exercise

Whale exercise gives one other bullish indicator for Ethereum. Regardless of the establishments transfer, whales have been accumulating ETH, with over 200,000 ETH added to their holdings prior to now three days alone.

This accumulation suggests confidence in Ethereum’s long-term prospects and will counterbalance the short-term promoting stress from establishments.

Good setup for breakout

Moreover, Ethereum’s fundamentals stay sturdy, regardless of low market sentiment. The rising adoption of L 2 options and the rising curiosity from whales alike make ETH well-positioned for a breakout.

Learn Ethereum (ETH) Price Prediction 2024-25

The mix of sturdy fundamentals, important whale accumulation, and the potential for a broader altcoin rally creates an ideal setup for Ethereum to maneuver greater within the close to future.

Whereas the current sell-off by establishments has created some short-term uncertainty, the underlying elements recommend that Ethereum’s value is poised to maneuver greater, doubtlessly breaking out as market circumstances enhance.