- ETH staking flipped from outflows to inflows proper after Pectra’s February announcement — not at launch.

- Inflows trace at early institutional alignment with Ethereum’s yield-friendly, validator-focused future post-upgrade.

Ethereum [ETH] lovers had been counting all the way down to the Pectra upgrade, anticipating that its validator-friendly modifications would reshape staking dynamics.

However the shift started sooner than anticipated — not at launch, however from the second Pectra’s roadmap was introduced in mid-February.

A recent report revealed that ETH staking flipped from months of outflows to web inflows virtually instantly after the improve was introduced.

Now that Pectra is formally reside, the rebound raises an even bigger query: is that this only a short-term response, or the primary sign of rising institutional confidence in Ethereum’s yield and infrastructure story?

Staking timeline

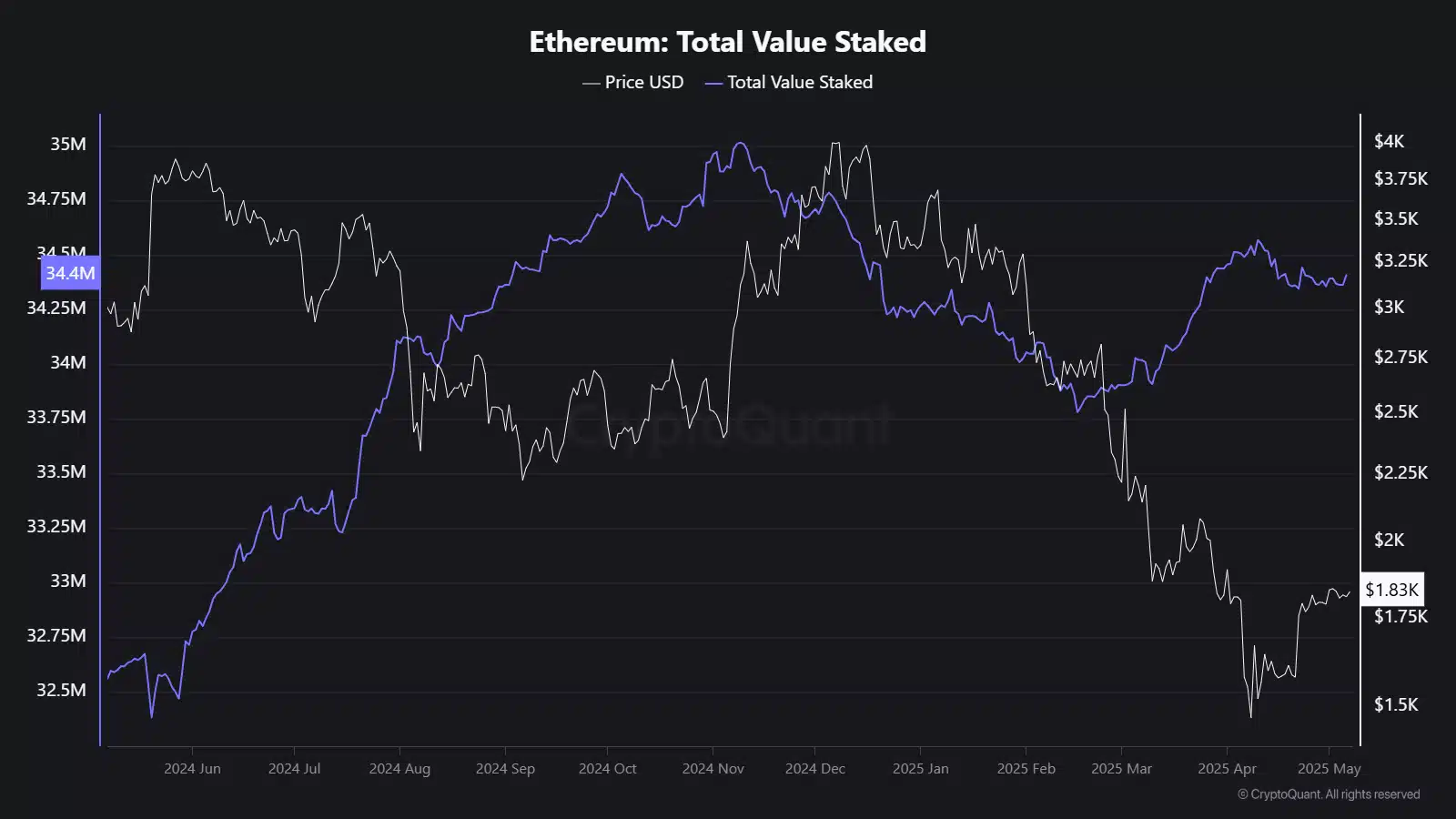

From the sixteenth of November to the fifteenth of February, staking participation declined notably — from roughly 34.88 million ETH to 33.86 million ETH.

That 1.02 million ETH outflow mirrored market jitters, seemingly stemming from regulatory pressures and the broader risk-off sentiment that dominated Q1.

However the announcement of Pectra round mid-February altered that pattern. From the sixteenth of February to the sixteenth of Might, ETH staking rebounded with a web influx of 627,000 ETH.

You’ll be able to’t ignore the timing — Ethereum’s validator-centric upgrades, together with EIP-7002’s versatile withdrawal credentials, landed properly with the ecosystem and will have reassured extra subtle stakeholders.

Staking inflows may sign rising institutional belief

Staking inflows typically mirror behavioral shifts. And Ethereum’s current tendencies recommend greater than only a retail return.

The restoration of confidence within the staking system factors towards a shift, presumably from establishments exploring or getting ready for Ethereum’s post-upgrade profile.

Key staking milestones — just like the Shanghai and Pectra upgrades — have traditionally pushed ETH flows.

Round every, we’ve seen positioning shift weeks earlier than the technical rollout, exhibiting the market’s forward-looking method.

With ETFs now in play and staking mechanics changing into extra versatile, Ethereum’s design is more and more pleasant to massive capital allocators.

The yield narrative

Ethereum’s native yield — by staking — has at all times been a central narrative. Now, with Pectra in place, that narrative positive aspects credibility and construction.

The diminished operational friction, paired with protocol-level enhancements, might appeal to additional inflows.

Whereas present influx volumes aren’t explosive, they’re directionally necessary.

A gradual however regular climb in staked ETH hints at a maturing market reassessing Ethereum’s yield potential — not simply as a retail yield farm, however as a strategic, regulated, and ETF-compatible yield product.