Once we take into consideration managing our funds, a number of the first few issues that come to thoughts are budgeting, saving, and maybe, coping with debt. For many individuals, their credit score rating isn’t one thing they think about till it’s time to use for a mortgage or purchase a house. As such, we are likely to overlook how vital our credit score rating is and why we should care for it.

A latest examine of how individuals manage their finances reveals that even small, on a regular basis selections can depart a long-lasting mark on their credit score rating well being. Easy issues like forgetting to pay a minor invoice or not realizing they’re growing their credit score utilization can shortly change into larger points that have an effect on credit score rating.

So, what are the sneaky issues that have an effect on your credit score rating, and how will you keep away from them? We’ll break down the important thing issues that have an effect on it and, extra importantly, take a look at how one can clear up them under.

Leap to…

What is a good credit score?

How much is a good credit score?

7 habits that could secretly be harming your credit score

How to avoid these hidden credit score mistakes

Why is a good credit score important?

Take control of your credit score today

What is an efficient credit score rating?

A credit score rating is a three-digit quantity, sometimes starting from 300 to 850, and it reveals how reliable you might be when repaying borrowed cash. A excessive credit score rating alerts accountable monetary conduct, whereas a decrease rating would possibly counsel room for enchancment. Lenders, landlords, and even some employers use credit score scores to evaluate an individual’s monetary duty. Credit score scores are often calculated based mostly on the next key components:

Cost historical past

This measures whether or not you persistently pay your payments on time, together with bank cards, loans, and utilities. Late or missed funds can negatively have an effect on your rating, even by a number of days. A constant cost historical past reveals lenders you’re dependable and accountable.

Credit score utilization

This refers back to the proportion of your accessible credit score you’re utilizing. For instance, in case your whole credit score restrict is 10,000 USD and also you owe 3,000 USD, your credit score utilization fee is 30%. Preserving this ratio low, ideally under 30% is vital. Excessive utilization suggests monetary pressure, which might decrease your rating.

Credit score historical past size

This considers how lengthy your credit score accounts have been energetic. Lenders take a look at the age of your oldest account, your latest account, and the common age of all of your accounts. An extended credit score historical past offers lenders extra perception into your monetary habits, so conserving older accounts open might help your rating.

Credit score combine

This evaluates the several types of credit score you handle, resembling bank cards, auto loans, and mortgages. A mixture of credit score sorts reveals you possibly can deal with a number of monetary obligations. Whereas not as crucial as cost historical past or utilization, it nonetheless positively contributes to your rating.

Credit score bureaus like Experian, TransUnion, and Equifax compile this info into experiences, which lenders use to evaluate your reliability.

With ExpressVPN’s Credit score Scanner, you possibly can view your Experian credit score rating and score, providing you with instantaneous perception into your monetary well being. Whether or not you’re monitoring adjustments, receiving alerts about potential exercise, or diving into detailed components affecting your rating, Credit score Scanner retains every thing easy and accessible by way of the ExpressVPN app. It’s accessible free of charge to ExpressVPN customers on the one- or two-year plan (U.S. solely).

How a lot is an efficient credit score rating?

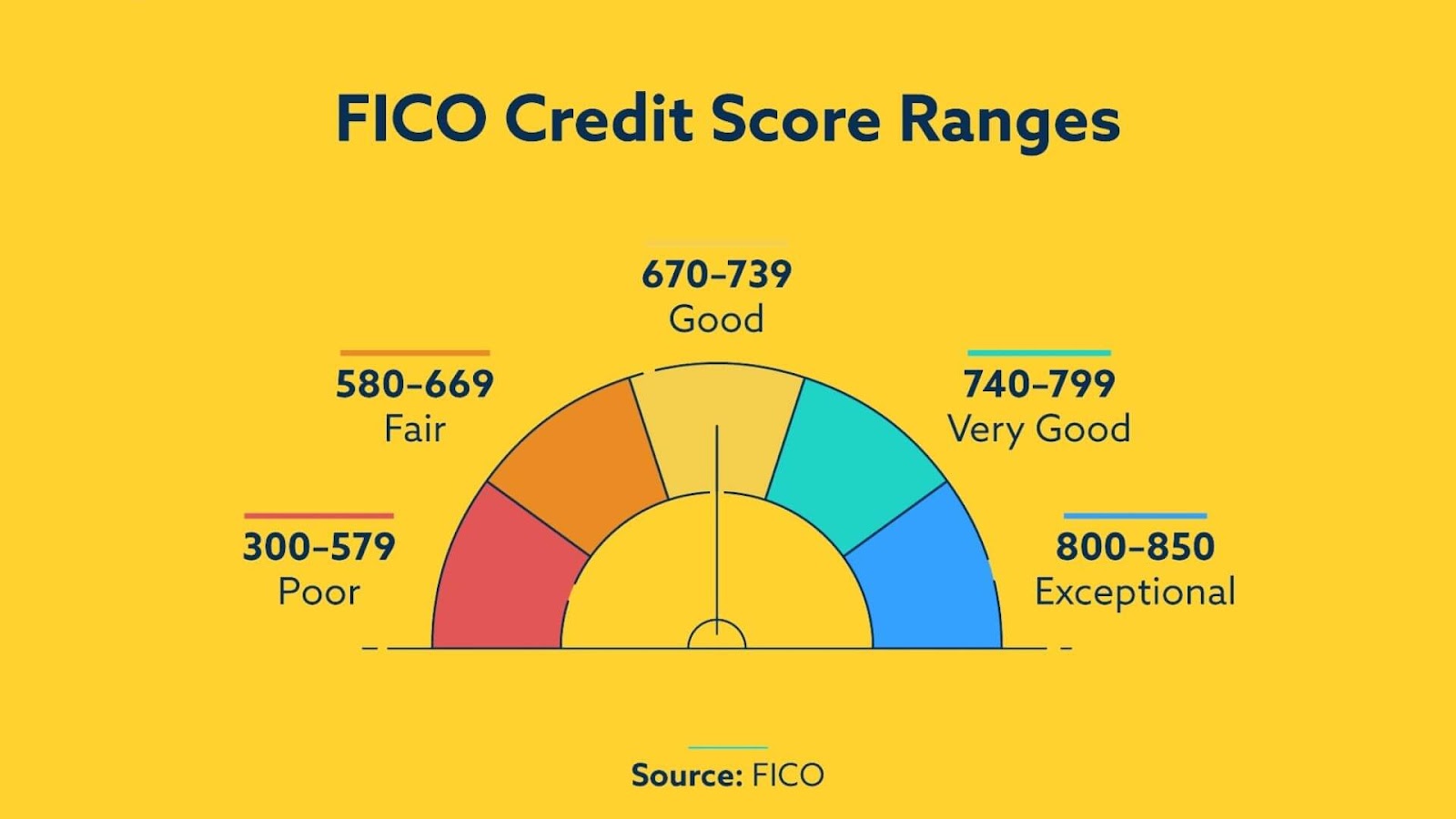

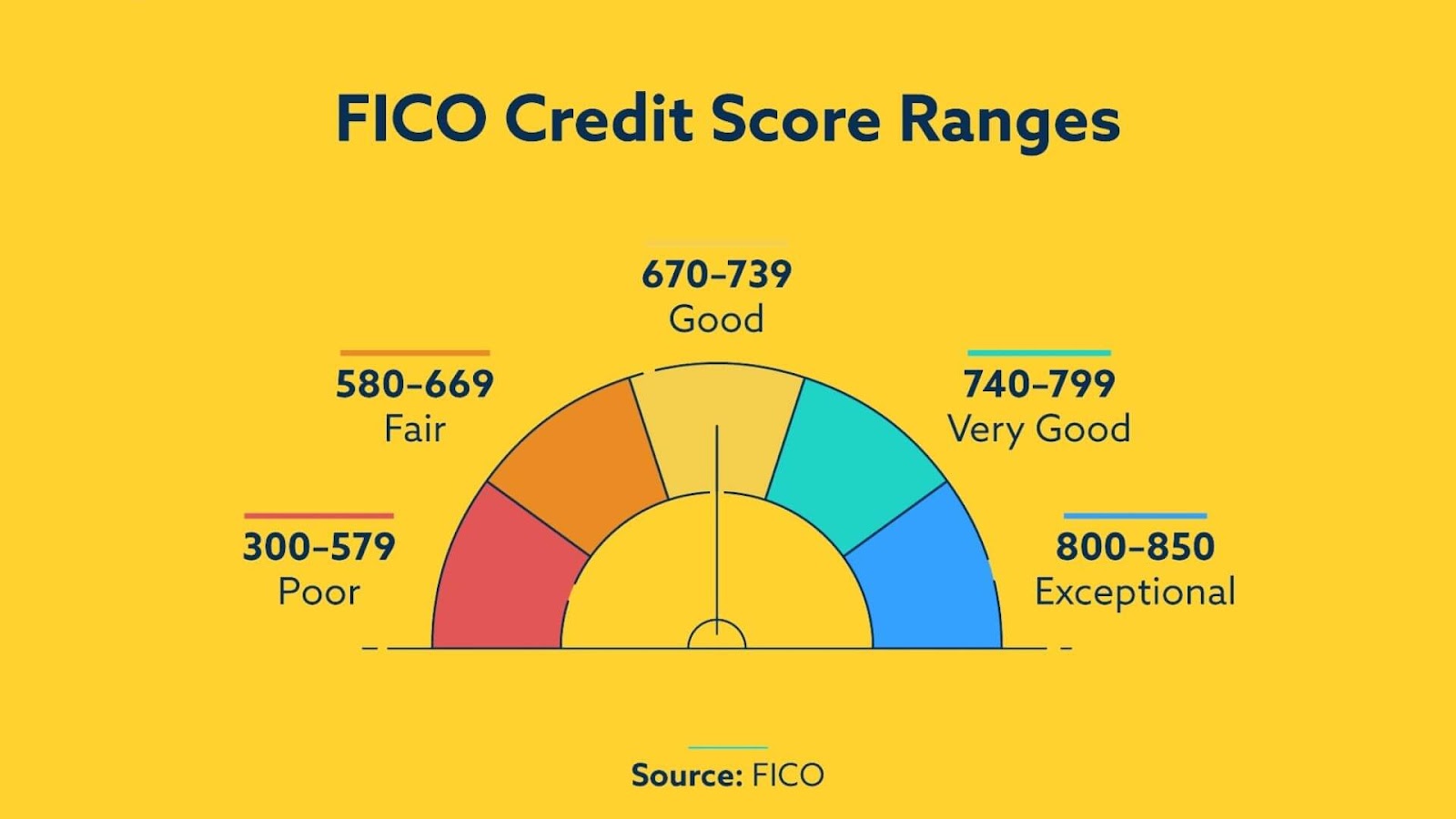

A superb credit score rating sometimes falls throughout the vary of 670 to 739, based mostly on the FICO scoring mannequin, which lenders extensively use. Right here’s how credit score scores are typically categorized:

| Poor (300–579) | This vary signifies vital credit score points, resembling missed funds or defaults. Debtors on this vary could battle to safe loans or face excessive rates of interest. |

| Honest (580–669) | Beneath common however not the worst. Debtors should qualify for credit score, however phrases are sometimes much less favorable. |

| Good (670–739) | The vary the place most debtors intention to be. This dependable rating permits for higher mortgage choices and affordable rates of interest. |

| Very Good (740–799) | A robust rating alerts stable monetary habits. Debtors on this vary typically obtain favorable phrases and perks from lenders. |

| Glorious (800–850) | The gold commonplace. Debtors with glorious credit score sometimes qualify for the perfect rates of interest and monetary merchandise. |

7 habits that might secretly be harming your credit score rating

Even in case you’re accountable with cash, small monetary habits may very well be quietly decreasing your credit score rating. In contrast to main purple flags like missed funds or mortgage defaults, these behaviors are simple to miss—however they’ll add up over time, making it more durable to get accepted for loans, leases, and even bank card perks. Right here’s what could be holding your rating again and tips on how to repair it.

1. Checking your credit score rating too typically

Many individuals assume checking their credit score ceaselessly is sweet monetary hygiene—however in case you’re utilizing companies that carry out exhausting inquiries, it could actually really decrease your rating. Arduous inquiries happen when lenders pull your credit score report back to approve loans or bank cards, and a number of checks inside a short while body can sign monetary misery.

2. Ignoring outdated money owed you thought had been gone

Unpaid money owed don’t simply disappear. Even small balances from forgotten utility payments, medical bills, or closed bank cards can find yourself in collections, slashing your rating. Worse, debt collectors can resell outdated money owed, making them resurface in your credit score report years later.

3. Making use of for retailer bank cards only for reductions

Retailers love to supply one-time reductions while you join a retailer bank card—however opening too many new accounts in a brief interval can harm your credit score. Every new card lowers the common age of your accounts and triggers exhausting inquiries, which briefly drop your rating.

4. Letting small automated funds slip by way of

Subscription companies, health club memberships, or small recurring prices could appear insignificant, however even one missed cost can keep in your credit score report for years. Some companies don’t report constructive cost historical past however will flag missed funds, resulting in a one-sided affect in your rating.

5. Utilizing an excessive amount of credit score, even in case you pay it off

A excessive credit score utilization fee—even in case you pay your invoice in full each month—can decrease your rating. Credit score bureaus take a look at the stability in your assertion cut-off date, not simply whether or not you clear it earlier than the due date.

6. Closing outdated accounts with out considering twice

It may appear sensible to shut unused bank cards, however doing so can shorten your credit score historical past and enhance your utilization fee, each of which might decrease your rating. The age of your accounts contributes to about 15% of your credit score rating, so older accounts carry weight.

7. Not checking your credit score report for errors

Hundreds of thousands of individuals have inaccurate credit score experiences as a consequence of clerical errors, fraud, or outdated info. These errors can result in decrease scores, greater rates of interest, and even mortgage denials. But, many individuals by no means test their experiences to catch them.

Easy methods to keep away from these hidden credit score rating errors

Monitor your credit score with out hurting your rating

As an alternative of utilizing companies that set off exhausting inquiries, go for instruments that use mushy inquiries—which allow you to test your credit score with out decreasing it.

Regulate outdated money owed

Verify your credit score report usually for unresolved balances or accounts which will have been despatched to collections. If you happen to discover an outdated debt, attain out to the creditor to settle it or dispute inaccuracies.

Be selective about new bank cards

Retailer bank card gives may be tempting, however assume twice earlier than signing up. If you happen to want a brand new bank card, area out purposes to keep away from a sudden drop in your credit score rating.

Automate funds to keep away from small however pricey errors

Arrange automated funds for subscription companies, utilities, and bank cards. Even small missed funds can depart a long-lasting mark in your credit score report.

Handle your credit score utilization properly

Attempt to hold your credit score utilization under 30%, even earlier than your assertion is due. Making a number of small funds all through the month might help hold your utilization low.

Maintain outdated accounts open

Until an account has excessive charges, conserving older bank cards open helps keep an extended credit score historical past and a greater utilization ratio.

Use ExpressVPN’s Credit score Scanner to remain on high of adjustments

Repeatedly reviewing your credit score report is the easiest way to catch errors, fraud, or potential points earlier than they escalate. ExpressVPN’s Credit Scanner permits you to monitor your credit score exercise in real-time so you possibly can keep knowledgeable with out affecting your rating.

Why is an efficient credit score rating vital?

Your credit score rating doesn’t simply have an effect on whether or not you get accepted for a mortgage. Your credit score rating influences many points of your monetary and private life. Right here’s why sustaining credit score rating is important:

Higher mortgage phrases

A excessive credit score rating means lenders view you as a dependable borrower, which frequently interprets to decrease rates of interest and higher phrases for loans and bank cards. This may prevent 1000’s of {dollars} over time.

Simpler approval for housing

Landlords and property managers ceaselessly test credit score scores to evaluate your reliability as a tenant. A superb rating will increase your probabilities of securing your required rental property with out further hurdles, resembling needing a co-signer.

Decrease insurance coverage premiums

Many insurance coverage suppliers use credit score scores to calculate auto, dwelling, and even life insurance coverage premiums. A robust credit score rating might help you safe decrease charges.

Employment alternatives

Some employers, notably these in monetary industries, assessment credit score experiences as a part of their hiring course of. A superb credit score rating displays duty and trustworthiness.

Utility and cell phone contracts

Utility corporations and cell carriers could run a credit score test earlier than organising service. A low credit score rating can result in greater deposits and even denial of service, whereas rating ensures smoother approvals.

Curiosity-free financing choices

Retailers providing interest-free financing for home equipment, electronics, or furnishings typically require credit score rating. The next rating might help you qualify for these promotions with out paying additional curiosity.

Decrease safety deposits

A robust credit score rating can prevent from paying giant safety deposits for leases, utility accounts, or different companies, releasing up money for different wants.

Emergency flexibility

Life is unpredictable, and having credit score rating ensures you’ll have entry to credit score while you want it most—for an surprising medical expense, automobile restore, or different emergency.

Peace of thoughts

A superb credit score rating is a monetary security internet. It offers you extra choices and larger freedom to make choices about your life with out worrying about being denied credit score or paying exorbitant rates of interest.

Take management of your credit score rating as we speak

Small habits can have a big effect in your monetary future. By avoiding these lesser-known credit score errors and keeping track of your credit score report, you possibly can keep a powerful rating and shield your monetary well being.

With ExpressVPN’s Credit score Scanner characteristic, you possibly can simply observe your credit score exercise, spot points early, and keep knowledgeable—all with out affecting your rating. Obtainable free of charge to U.S. customers with a one- or two-year ExpressVPN plan.

FAQ: About good credit score scores

Credit score scores don’t have age-specific benchmarks, however they typically replicate your monetary habits and credit score historical past size, which naturally enhance as you age. Right here’s a common information:

- 18 to 24 Years Previous: Many younger adults are simply beginning to construct credit score. Scores within the mid-600s are widespread as they set up their credit score histories.

- 25 to 34 Years Previous: With extra time to handle credit score, scores typically climb into the 670 to 740 vary, particularly for these working towards good monetary habits.

- 35 to 49 Years Previous: By this stage, many have well-established credit score histories, typically resulting in scores within the 700s or greater.

- 50+ Years Previous: Individuals on this age group sometimes keep the best scores (above 750) as a consequence of lengthy credit score histories and constant compensation habits.

Bear in mind, these are averages, and particular person scores can differ based mostly on monetary conduct, not simply age.

Credit score scores typically fall into 5 classes, based on the FICO scoring mannequin:

- Poor (300–579): Important credit score points, resembling defaults or excessive debt. Approval for brand new credit score is uncommon.

- Honest (580–669): Beneath common however not horrible. Credit score approval is feasible, however phrases could also be much less favorable.

- Good (670–739): Thought-about a stable rating. Most lenders supply first rate phrases and approval charges.

- Very Good (740–799): A robust rating that sometimes qualifies for higher charges and bank card perks.

- Glorious (800–850): The gold commonplace of credit score scores. Debtors on this vary typically obtain the perfect mortgage phrases and lowest rates of interest.

Whereas necessities differ by lender, a credit score rating of 620 is commonly the minimal wanted to qualify for many standard mortgages. Nonetheless, the next rating can prevent 1000’s over the lifetime of your mortgage:

- 620–679: You’ll qualify for a mortgage, however rates of interest could also be greater.

- 680–739: A superb vary for securing favorable phrases on standard loans.

- 740+: The candy spot. Debtors on this vary qualify for the perfect rates of interest and mortgage choices.