Keep knowledgeable with free updates

Merely signal as much as the Cryptocurrencies myFT Digest — delivered on to your inbox.

The primary particular person to be convicted within the UK for operating a community of crypto ATMs has been sentenced to 4 years in jail.

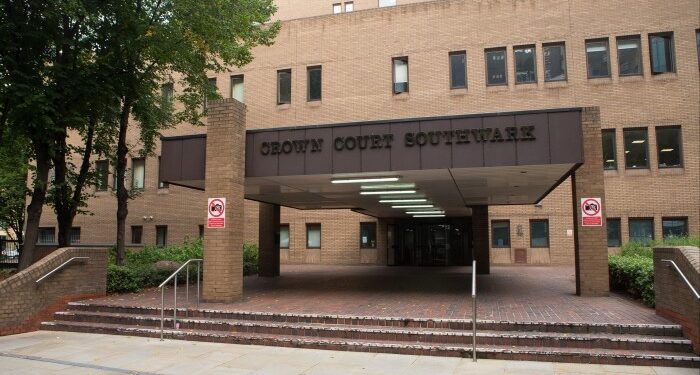

Olumide Osunkoya, 46, had dedicated “an especially critical offence”, Choose Gregory Perrins mentioned on Friday at London’s Southwark Crown Court docket, handing down the sentence.

The UK Monetary Conduct Authority brought five charges against Osunkoya final 12 months for unlawfully operating a number of crypto ATMs with out registration, falsifying paperwork, and possessing legal property between December 2021 and September 2023.

Osunkoya pleaded responsible to all the costs in September 2024.

Crypto ATMs, or CATMs, are machines that allow individuals purchase or convert cash into crypto property. Working in an analogous approach to a typical financial institution ATM, CATMs can absorb money, convert it to a cryptocurrency reminiscent of bitcoin, and ship the digital cash to a buyer’s crypto pockets deal with.

Authorities all over the world have sought to close crypto ATMs down as a result of they’re deemed a perfect approach to launder cash, with little traceability on the place funds come from or the place they’re despatched. Operators usually earn charges on transactions.

Perrins mentioned of crypto ATMs: “When used unscrupulously they’re little greater than cash laundering machines.”

There are not any authorized crypto ATM operators within the UK. The regulator alleged Osunkoya ran a minimum of 11 CATMs, which processed greater than £2.5mn in transactions within the indictment interval.

“Your actions had been in my judgment deliberate, rigorously deliberate and intensely critical,” mentioned Perrins, including that Osunkoya’s offences had “required a big diploma of sophistication and planning” and he had made “a excessive diploma of monetary acquire”.

Osunkoya had “lied repeatedly”, the decide mentioned when handing down the sentence, including he had acted in “deliberate and calculated defiance to the regulator”. He earned a minimum of £500,000 in revenue, the decide mentioned, including he earned 20 to 30 per cent fee on trades. The FCA has requested the court docket provoke proceedings to recuperate any monetary profit Osunkoya constructed from his crimes.

A barrister for the FCA informed the court docket that Osunkoya had utilized to function CATMs and had been turned down by the regulator in 2021. The watchdog made it clear to Osunkoya that it was an offence for him to proceed to run the machines with out permission, Matthew Butt KC mentioned.

Osunkoya then created a “fictitious character” named Yarik Wolnik to function his enterprise below. When Osunkoya was arrested in September 2023 police discovered £19,500 in his home, which he claimed was for family payments.

Woman-Gené Waszkewitz, performing for Osunkoya, mentioned in mitigation that he had been identified with a “fairly extreme type of sickle cell illness . . . for which he receives common remedy”.

Due to his well being situation, “there’s a actual doubt about his capacity to be handled appropriately within the jail system,” Waszkewitz mentioned, including he had no prior convictions.

Osunkoya’s household largely stay in Nigeria, the place his mom just lately suffered a stroke, whereas he additionally helps his two-year-old daughter, who lives together with her mom in London, Waszkewitz mentioned.

Osunkoya mentioned in pre-trial paperwork that he wanted the cash from working crypto ATMs to assist the price of his sister’s most cancers remedy. However Perrins mentioned the court docket had seen no proof to assist this.

The utmost sentence for forgery and utilizing a false instrument is as much as 10 years in jail, for possession of legal property it’s as much as 14 years in jail and for working of crypto ATMs with out FCA registration it’s two years.

“That is the UK’s first legal sentencing for unregistered crypto exercise and sends a transparent message: those that flout our guidelines, search to evade detection and have interaction in legal exercise will face critical penalties,” mentioned Therese Chambers, joint govt director of enforcement and market oversight on the FCA.