Maximizing Bitcoin Positive aspects with ETF Information

For the reason that introduction of Bitcoin Trade Traded Funds (ETFs) in early 2024, Bitcoin has reached new all-time highs, with a number of months of double-digit positive factors. Nonetheless, as spectacular as this efficiency is, there is a option to considerably outperform Bitcoin’s returns by using ETF information to information your buying and selling choices.

Bitcoin ETFs and Their Affect

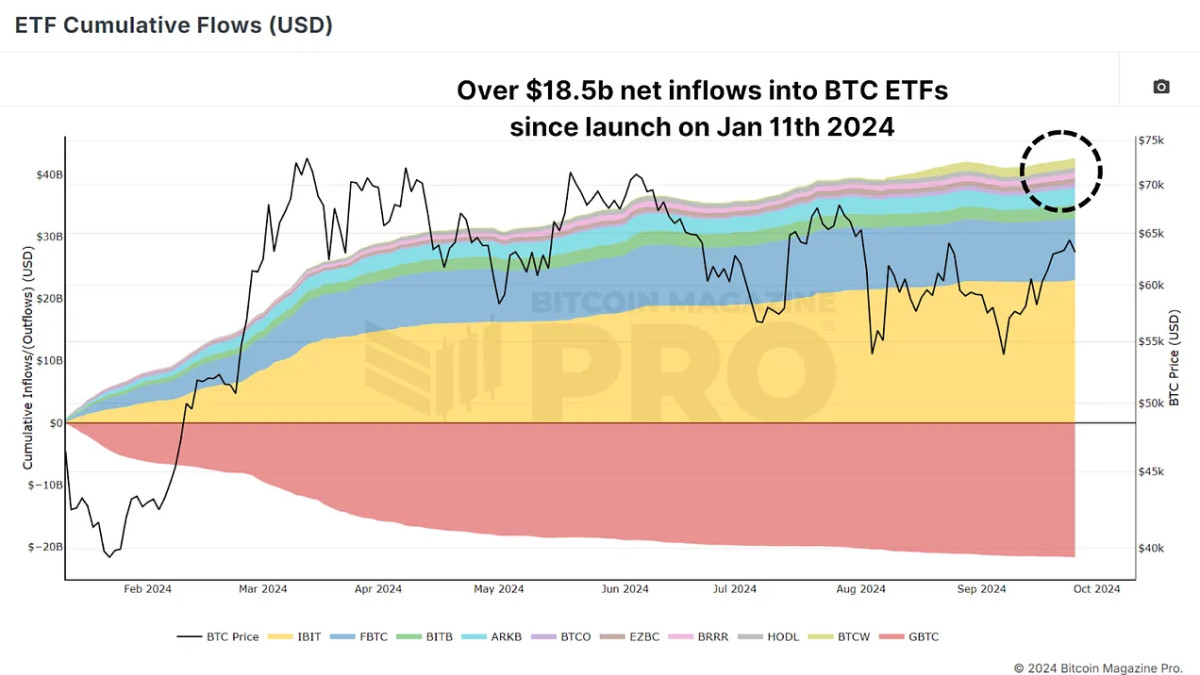

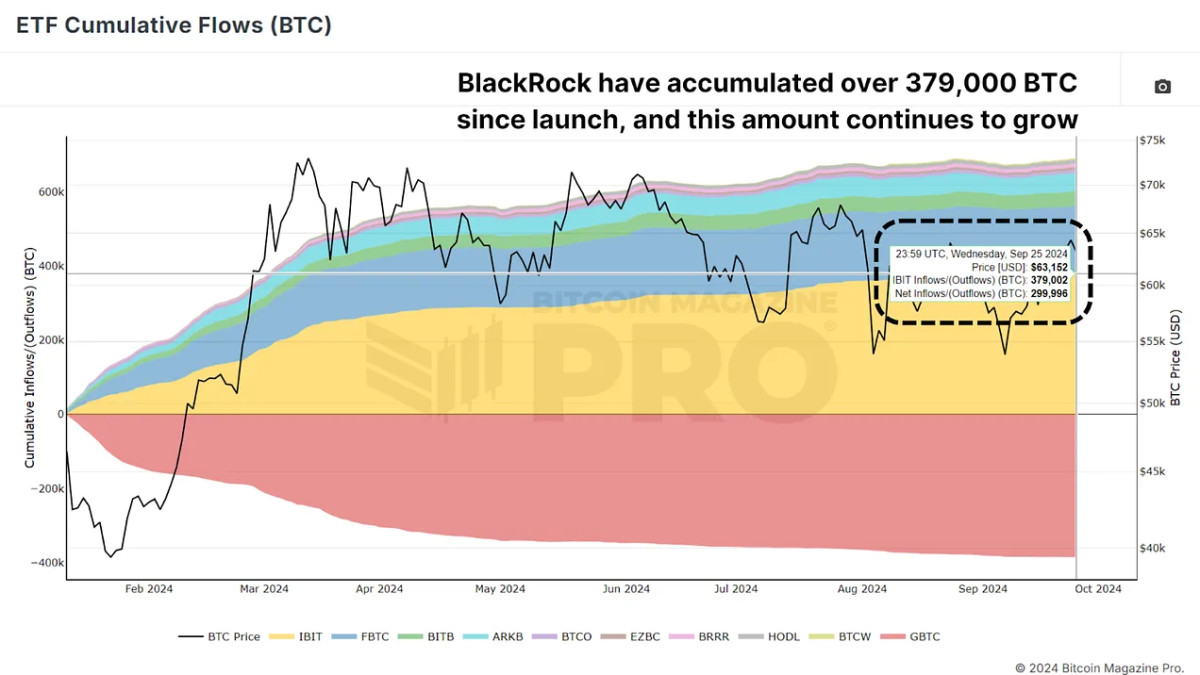

Bitcoin ETFs, launched in January 2024, have shortly amassed giant quantities of Bitcoin. These ETFs, tracked by numerous funds, enable institutional and retail traders to achieve publicity to Bitcoin with out straight proudly owning it. These ETFs have accumulated billions of USD worth of BTC, and monitoring this cumulative move is crucial for monitoring institutional exercise in Bitcoin markets, serving to us gauge whether or not institutional gamers are shopping for or promoting.

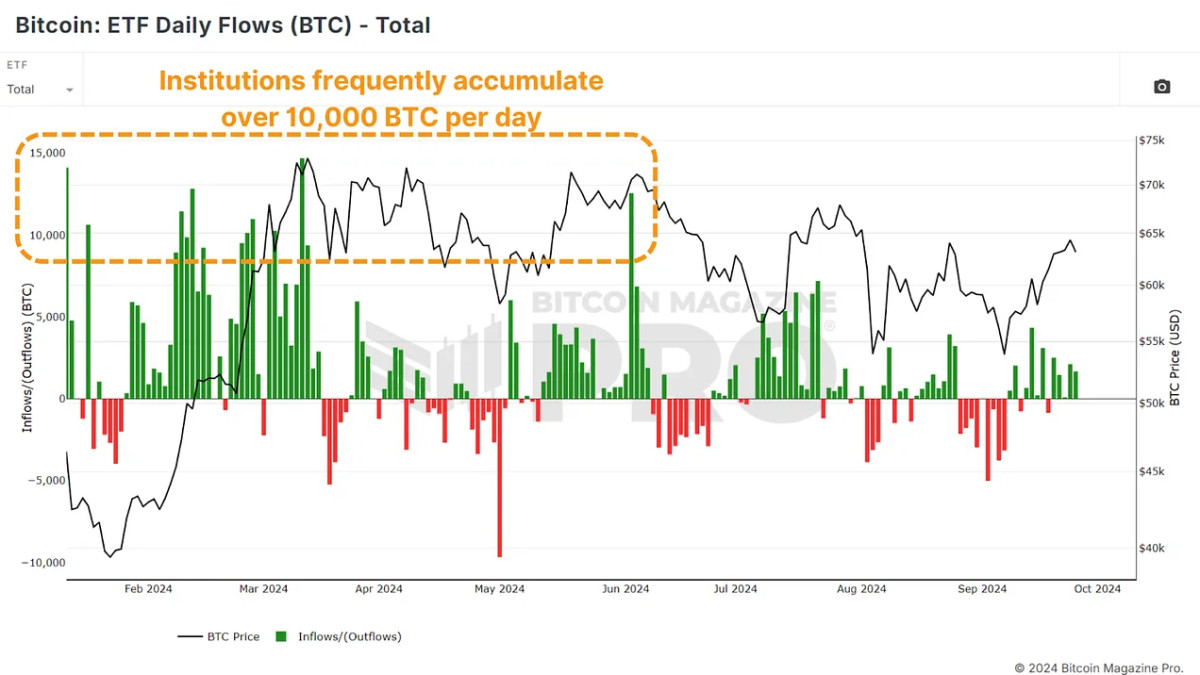

ETF daily inflows denominated in BTC point out that large-scale traders are accumulating Bitcoin, whereas day by day outflows counsel they’re exiting positions throughout that buying and selling interval. For these trying to outperform Bitcoin’s already robust 2024 efficiency, this ETF information gives a strategic entry and exit level for Bitcoin trades.

A Easy Technique Primarily based on ETF Information

The technique is comparatively simple: purchase Bitcoin when ETF inflows are optimistic (inexperienced bars) and promote when outflows happen (pink bars). Surprisingly, this methodology lets you outperform even throughout Bitcoin’s bullish intervals.

This technique, whereas easy, has constantly outperformed the broader Bitcoin market by capturing value momentum on the proper moments and avoiding potential downturns by following institutional developments.

The Energy of Compounding

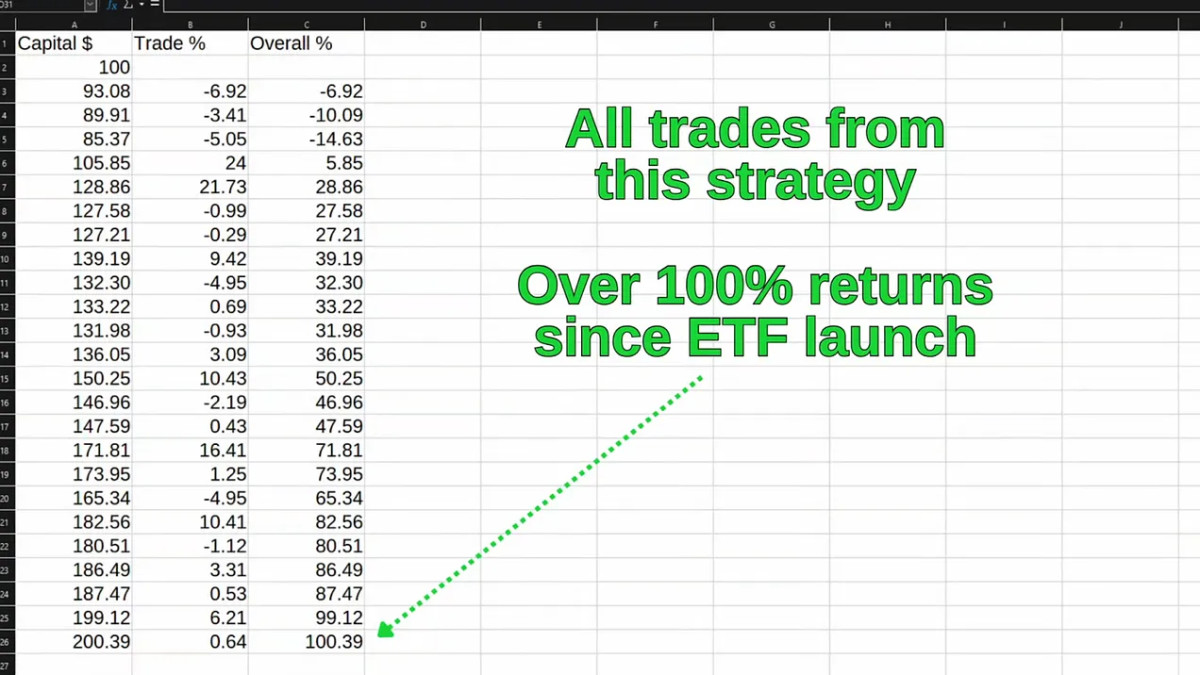

The true secret to this technique lies in compounding. Compounding positive factors over time considerably boosts your returns, even during times of consolidation or minor volatility. Think about beginning with $100 in capital. In case your first commerce yields a ten% return, you now have $110. On the subsequent commerce, one other 10% achieve on $110 brings your whole to $121. Compounding these positive factors over time, even modest wins, accumulate into important earnings. Losses are inevitable, however compounding wins far outweigh the occasional dip.

For the reason that launch of the Bitcoin ETFs, this technique has supplied over 100% returns throughout a interval during which simply holding BTC has returned roughly 37%, and even in comparison with shopping for Bitcoin on the ETF launch day and promoting on the actual all-time excessive, which might have returned roughly 59%.

Can Additional Upside Be Anticipated?

Just lately, we’ve begun to see a sustained trend of positive ETF inflows, suggesting that establishments are as soon as once more closely accumulating Bitcoin. Since September nineteenth, daily has seen optimistic inflows, which, as we will see, have usually preceded value rallies. BlackRock and their IBIT ETF alone have collected over 379,000 BTC since inception.

Conclusion

Market situations can change, and there’ll inevitably be intervals of volatility. Nonetheless, the constant historic correlation between ETF inflows and Bitcoin value will increase makes this a priceless software for these trying to maximize their Bitcoin positive factors. If you happen to’re on the lookout for a low-effort, set-it-and-forget-it strategy, buy-and-hold should be appropriate. Nonetheless, if you wish to attempt to actively improve your returns by leveraging institutional information, monitoring Bitcoin ETF inflows and outflows might be a game-changer.

For a extra in-depth look into this subject, try a latest YouTube video right here: Using ETF Data to Outperform Bitcoin [Must Watch]