Bitcoin is closing out considered one of its most exceptional months in historical past, surging over $30,000 in November and marking a renewed bullish sentiment out there. As we stay up for December and past, traders are keen to grasp whether or not Bitcoin’s momentum can maintain itself into 2025. With macroeconomic circumstances, historic traits, and on-chain information aligning in Bitcoin’s favor, let’s analyze what’s occurring and what it might imply for the longer term.

November’s Report-Breaking Efficiency

November 2024 wasn’t simply any month for Bitcoin; it was historic. Bitcoin’s value rose from round $67,000 to almost $100,000, an approximate 50% peak-to-trough enhance, making it the best-performing month ever by way of greenback enhance. This rally rewarded long-term holders who endured months of consolidation after Bitcoin’s all-time excessive of $74,000 earlier within the yr.

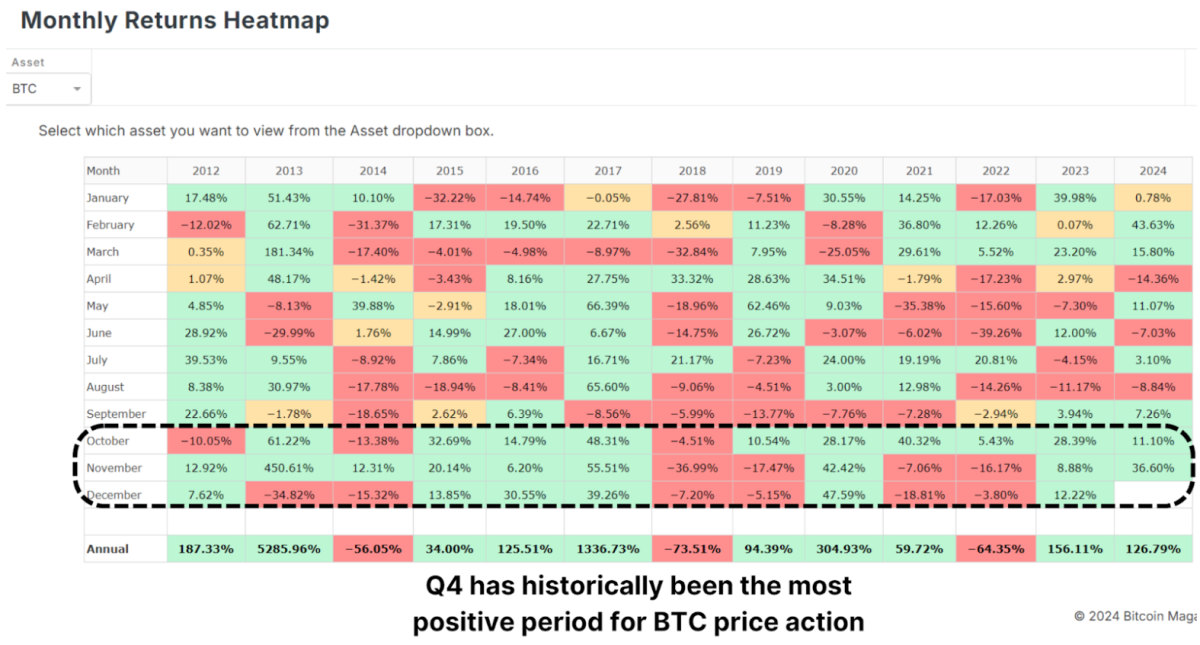

Traditionally, This fall is Bitcoin’s strongest quarter, and November has typically been a standout month. December, which has additionally carried out nicely in previous bull cycles, presents a promising outlook. However as with all rally, some short-term cooling is likely to be anticipated.

The Function of the Greenback and International Liquidity

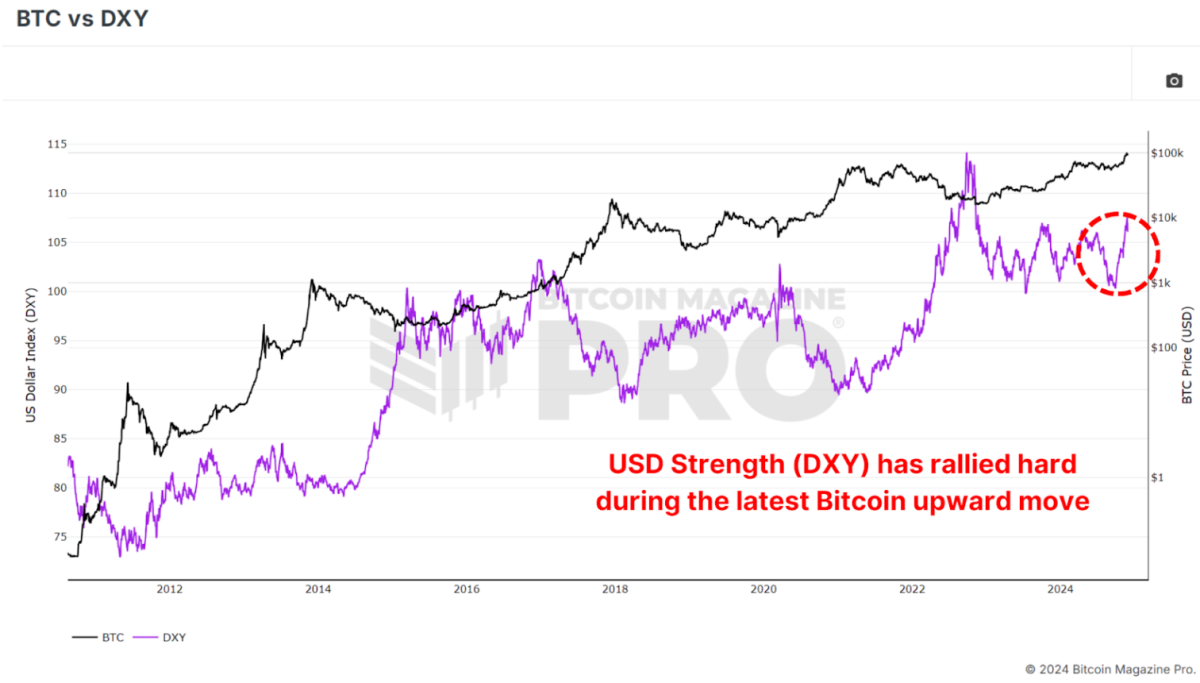

Curiously, Bitcoin’s rise occurred in opposition to the backdrop of a strengthening U.S. Dollar Strength Index (DXY), a situation that sometimes sees Bitcoin underperforming. Traditionally, Bitcoin and the DXY have maintained an inverse relationship: when the greenback strengthens, Bitcoin weakens, and vice versa.

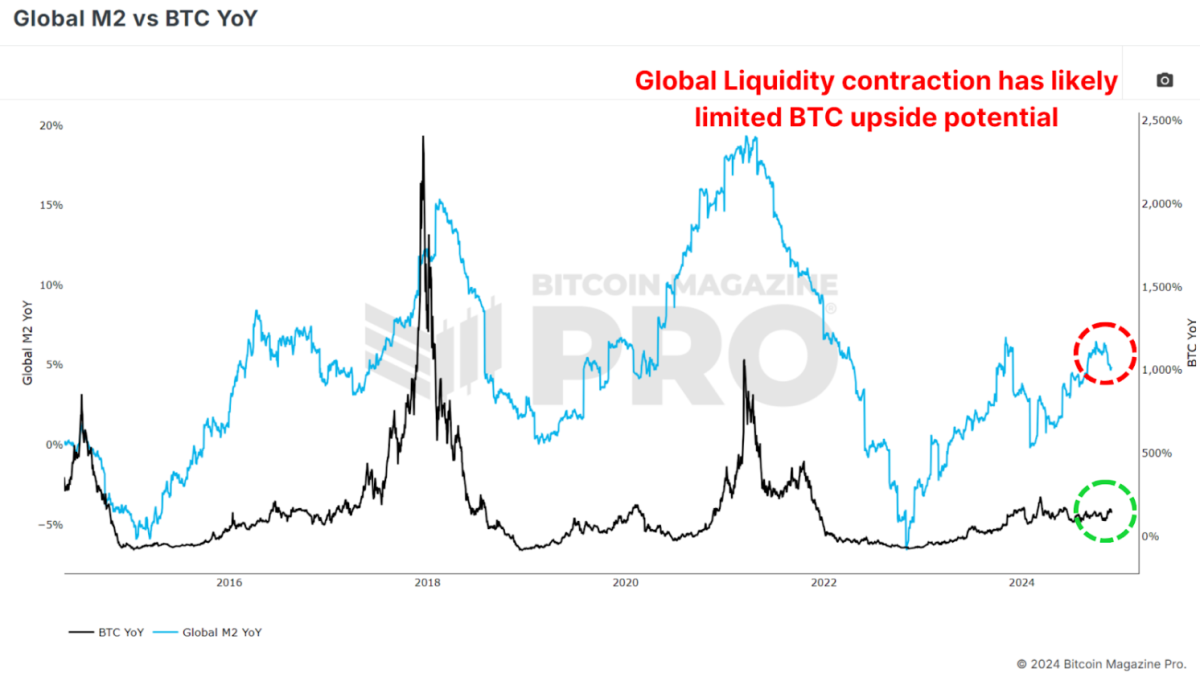

Equally, the Global M2 cash provide, one other key metric, has proven a slight contraction not too long ago. Bitcoin has traditionally correlated positively with world liquidity; thus, its present efficiency defies expectations. If liquidity circumstances enhance within the coming months, this might act as a robust tailwind for Bitcoin’s value.

Parallels to Previous Bull Cycles

Bitcoin’s present trajectory is strikingly just like previous bull markets, significantly the 2016–2017 cycle. That cycle started with gradual value will increase earlier than breaking key resistance ranges and getting into an exponential development section.

In 2017, Bitcoin’s value broke out from a key technical stage of round $1,000, resulting in a parabolic rally that peaked at $20,000, a 20x enhance. Equally, the 2020-2021 cycle noticed Bitcoin rise from $20,000 to almost $70,000 after breaking above the essential YoY Performance threshold.

If Bitcoin can escape decisively from this historic stage and above the important thing $100,000 resistance, we might witness a repeat of those explosive value actions as BTC enters its exponential section of bullish value motion.

Institutional Adoption and Accumulation

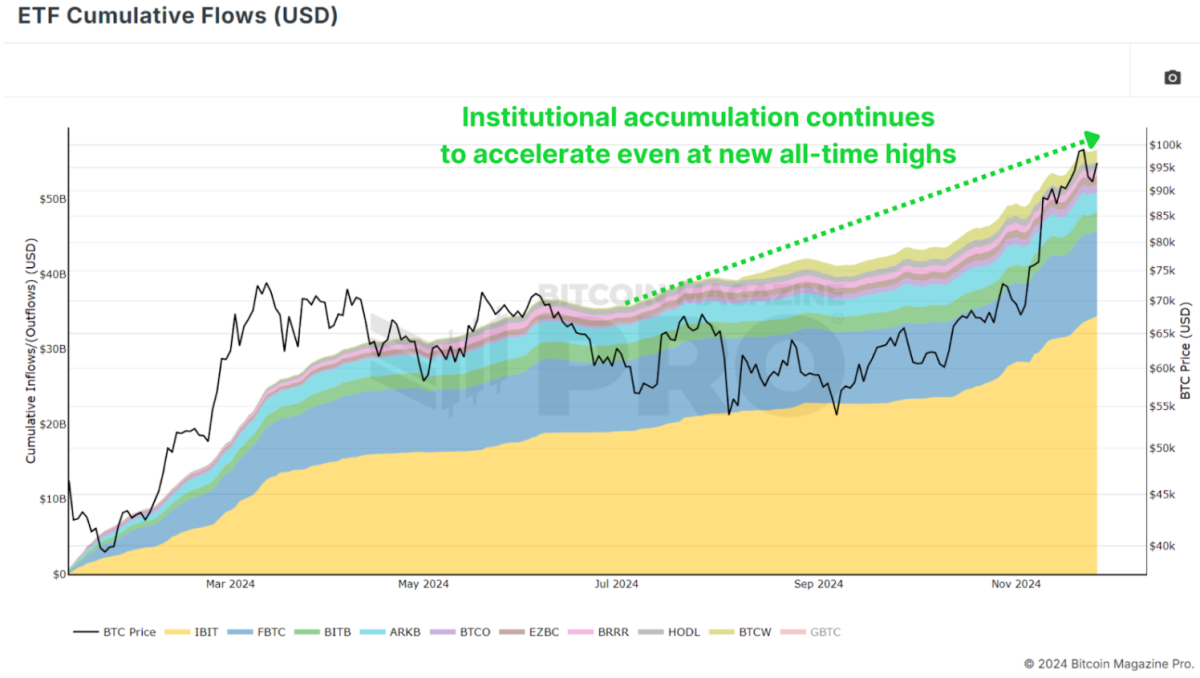

A key issue underpinning Bitcoin’s energy is the continued accumulation by establishments. Bitcoin ETFs are including billions of {dollars} price of BTC to their holdings, and companies like MicroStrategy have doubled down on their Bitcoin technique, now holding near 400,000 BTC. Even with BTC rallying to new all-time highs, ‘sensible cash’ is scrambling to build up as a lot as potential to make sure they’re not left behind.

This institutional demand signifies rising confidence in Bitcoin as a long-term retailer of worth, even in unstable market circumstances. Such accumulation additionally tightens the accessible provide, creating upward strain on costs as demand will increase.

Conclusion

Whereas December has traditionally been a powerful month for Bitcoin, short-term volatility might mood positive aspects because the market digests November’s sharp rally. Though given the aggressive accumulation we’re witnessing from institutional contributors something is feasible.

Longer-term, nevertheless, the outlook stays exceptionally bullish. The apparent stage to look at is $100,000 as the following main milestone, which, if breached, might pave the best way for a a lot bigger rally in 2025. Bitcoin is getting into considered one of its most enjoyable phases but, with the celebs seemingly aligning throughout macroeconomic, technical, and on-chain metrics.

For a extra in-depth look into this matter, try a current YouTube video right here: The BIGGEST Bitcoin Month EVER – So What Happens Next?

🎁 Black Friday: Our Largest Ever Sale

The BEST saving of the yr is right here. Get 40% Off all our annual plans.

- Unlock +100 Bitcoin charts.

- Entry Indicator alerts – so that you by no means miss a factor.

- Non-public TradingView indicators of your favourite Bitcoin charts.

- Members-only Experiences and Insights.

- Many new charts and options coming quickly.

All for simply $15/month with the Black Friday deal. That is our largest sale all yr.

UPGRADE YOUR BITCOIN INVESTING NOW

Do not miss out! 👉 https://www.bitcoinmagazinepro.com/subscribe/